What is SBI Mini Statement, Netbanking, Missed Call & SMS?

SBI mini statements provide all the details of your latest five transactions brought about by various modes like NEFT, IMPS, RTGS, UPI, etc. If your mobile number is registered with the bank, you can easily get an SBI missed call mini statement or mini-statement SBI by SMS.

How to Get SBI Mini Statement?

You can get your SBI statement using any of the following options after registering your mobile number with the bank:

SBI Missed Call Mini Statement

One of the simplest methods is using SBI Quick Missed Call service. All you have to do is give a missed call on the contact number – 09223866666 from your registered mobile number.

The call will be disconnected after two rings. Soon after, you will get the SBI statement by SMS with the recent five transactions initiated from the account.

This SBI missed call mini statement method is the easiest and is accessible even without the internet.

SBI Mini Statement by SMS

Send an SMS –“MSTMT” to 09223866666 from your mobile number that is registered with the bank. Soon, you will obtain an SMS with details of your latest five transactions.

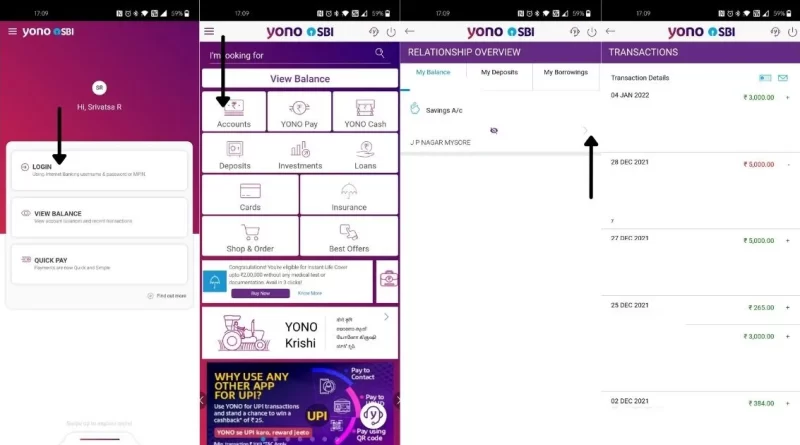

Mobile Banking

SBI’s mobile application, YONO SBI Lite, is available for Android and iOS devices. You can download this app from Google Playstore or Apple App Store.

Log in to the app using your Username and Password. Navigate to account details and view your transactions. However, this service requires a smartphone and an internet connection.

SBI Net Banking

In addition to the app, SBI offers net banking services to its account-holders. You can log in to the SBI Net Banking site using your user id and password. Navigate the ‘Account Details’ section and check your latest transactions.

You can also manage your multiple accounts, access detailed statements and transaction history, and more using net banking services.

SBI ATM

Another easy method for accessing your account’s mini statements is using your SBI ATM card. Visit the nearest SBI bank ATM, select the ‘Mini Statement’ option on the display screen, enter the 4-digit PIN, and view the mini statement.

How to Register Your Mobile Number for SBI Mini Statement?

This quick service of SBI Mini Statement by missed call or SMS is only available if your phone number is registered with the bank. So, it is vital to register your mobile number to avail SBI statement by SMS. Usually, your account is registered with the bank when you open an account. The number you fill out on the account opening form gets registered for SMS services. However, if there is a change in your number, you can follow the procedure mentioned below.

To register the mobile number for SBI Quick services, wherein you can access SBI missed call mini statement or SBI statement by SMS, the account holder must send an SMS to the bank. The format of the SMS has to be as follows:

REG<space>Account Number

The account holder must send this SMS with their account number to 09223488888. Soon after, the mobile number will be registered with SBI, and you will receive a confirmation email.

To register your phone number for mobile banking facilities, you will have to send the following SMS to 9223440000:

<MBSREG>

Note: If an account holder has multiple accounts with SBI, they can register for SBI Quick for only a particular account at a time. If they wish to change the registered account number for the SBI Quick service, they can deregister from the first account and register with the second one.

Benefits of SBI Mini Statement Service

The automated SBI statement services offer several benefits to an account holder, including

- You need not log into your SBI online banking accounts to access information.

- It is simpler and quicker.

- You will not have to stand in queues to update your passbook so you can view minute details.

- The process saves time and effort.

- You just require a phone with SMS services. For SBI missed call mini statement service, you do not require an internet connection or a smartphone.

- It is a seamless, stress-free, and hassle-free process.

SBI mini statement by SMS is one of the easiest and quickest methods to view your last five SBI Credit Card transaction details. It helps you keep a check on any incoming or outgoing payments without having to visit the branch for confirmation.